Carbon Tax

A carbon tax is a financial charge imposed on the carbon content of fossil fuels. Its primary goal is to reduce greenhouse gas emissions by making fossil fuels more expensive. Thereby, it encourages businesses and consumers to shift towards cleaner energy sources. The tax is typically applied at various points in the supply chain, such as production or distribution. Revenue generated are purpose driven. i.e. funding renewable energy projects, reducing other taxes, or direct redistribution to citizens.

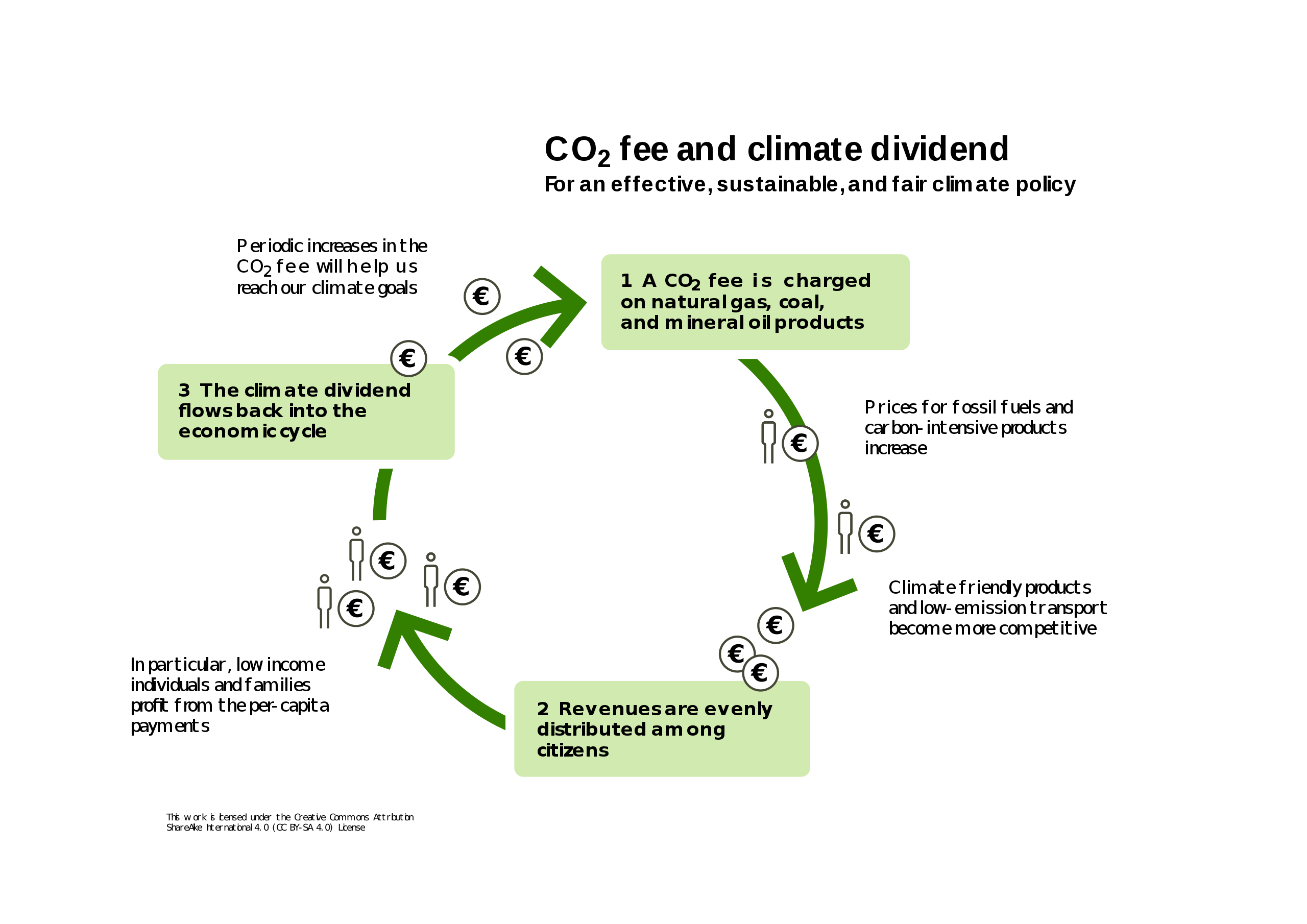

Carbon Fee & Dividend

The carbon fee and dividend system, also known as climate income, imposes a fee on the carbon content of fossil fuels. Then, it redistributes the revenue to the population as regular payments. This model aims to reduce emissions, while maintaining economic stability. By returning the revenue directly to citizens, it offsets the increased cost of goods and services due to the carbon fee. Also, it ensures that lower/middle-income households benefit or at least break even financially. This system has been implemented in various regions, including Canada and Switzerland.

Key Differences and Benefits

- Revenue Use:

- Carbon Tax: Revenue can be allocated to various governmental needs or projects.

- Carbon Fee & Dividend: Revenue is returned directly to citizens, maintaining a revenue-neutral stance.

- Economic Impact:

- Both systems aim to reduce carbon emissions. Even so, the dividend approach helps to reduce potential economic burdens. It provides direct compensation to lower-income households.

- Implementation and Effectiveness:

- Carbon Tax: it is straightforward, but may face public resistance. This is due to perceived cost increases without direct personal benefit.

- Carbon Fee & Dividend: More likely to gain public acceptance, because it returns funds to citizens. Thereby offsetting increased costs.

Conclusion

Both carbon tax and carbon fee & dividend systems offer viable methods to reduce greenhouse gas emissions. The choice between them depends on economic and social considerations. The carbon fee & dividend provides a more equitable solution. It addresses a direct compensation of households for increased living costs due to carbon pricing.